OUR VALUATIONS

A quantum leap of professional integrity and accuracy

Quantum Valuations is a boutique valuation service with over 30 years of experience within the commercial, industrial, and residential sector.

1. Send us an enquiry

Enter your details outlining the property details and reason for valuation.

2. Get a Quotation

We assess your enquiry and send you a quote with helpful information.

3. Valuation Process

Once the quote is accepted, the valuation process will begin.

In some cases, a 50% deposit may be required to initiate the process.

4. Property Inspection

We arrange an date and time at your convenience. During the inspection, we will measure improvements, take photographs, and gather relevant property information.

5. Valuation Report

You receive a comprehensive written valuation report. The turnaround time my vary depending on the size and type of the property, or the extent of research.

6. Final Payment

The invoice for the final payment will be sent upon receipt of the valuations.

Property Management

Property Management Companies

Property management companies rely on accurate valuations to fulfil their legal obligations, ensure proper financial planning, and make informed decisions related to property maintenance, insurance coverage, and budgeting for future expenses.

Insurance Valuations

Sectional Title Schemes

As per the Sectional Titles Act 95 of 1986 and the more recent Sectional Titles Schemes Management Act 8 of 2011, insurance valuations are required every three years for sectional title schemes.

These valuations help determine the replacement cost of buildings and common areas within the scheme, ensuring adequate insurance coverage.

Common Property Valuations

Home Owners Associations

Home owners’ associations

are responsible for managing and maintaining common property areas within residential developments.

Property valuations are essential for internal roads, security buildings, perimeter walling, and other shared amenities to determine their current market value.

The executor is the person who is appointed

by the Master to administer the deceased estate. The deceased nominates an executor in his or her will and the Master appoints such executor subject to certain requirements.

Homeowners seeking to understand the current market value of

their property often request valuations. Additionally, sellers may need valuations to determine an appropriate listing price for their property.

Prospective buyers and real estate investors require valuations to ensure they are making informed decisions and paying a fair price for the property.

Banks, mortgage lenders, and other financial institutions need property valuations to assess the collateral value of real estate for mortgage approvals and loan underwriting.

Real estate professionals may engage property valuers to provide accurate market assessments and guide their clients in pricing and negotiations.

Property developers use valuations to assess the feasibility of a project and determine the potential value of the developed property.

Lawyers and attorneys involved in property-related legal matters, such as divorces, inheritance disputes, or property settlements, rely on valuations as evidence in court proceedings.

Government entities and municipalities require property valuations for tax assessment, eminent domain proceedings, or land use planning.

Insurance companies use valuations to determine the replacement cost or insurable value of properties for insurance coverage.

Corporations may need valuations for financial reporting, asset allocation, or corporate restructuring purposes.

Non-profit organizations may require valuations for property donations or estate planning.

BENEFITS

Valuations that make sense for you.

We combine technical expertise, market knowledge, and attention to detail to provide you with accurate and credible property valuations.

Un-biased and independent

Precise market insights

Flexible valuation solutions

FEATURES

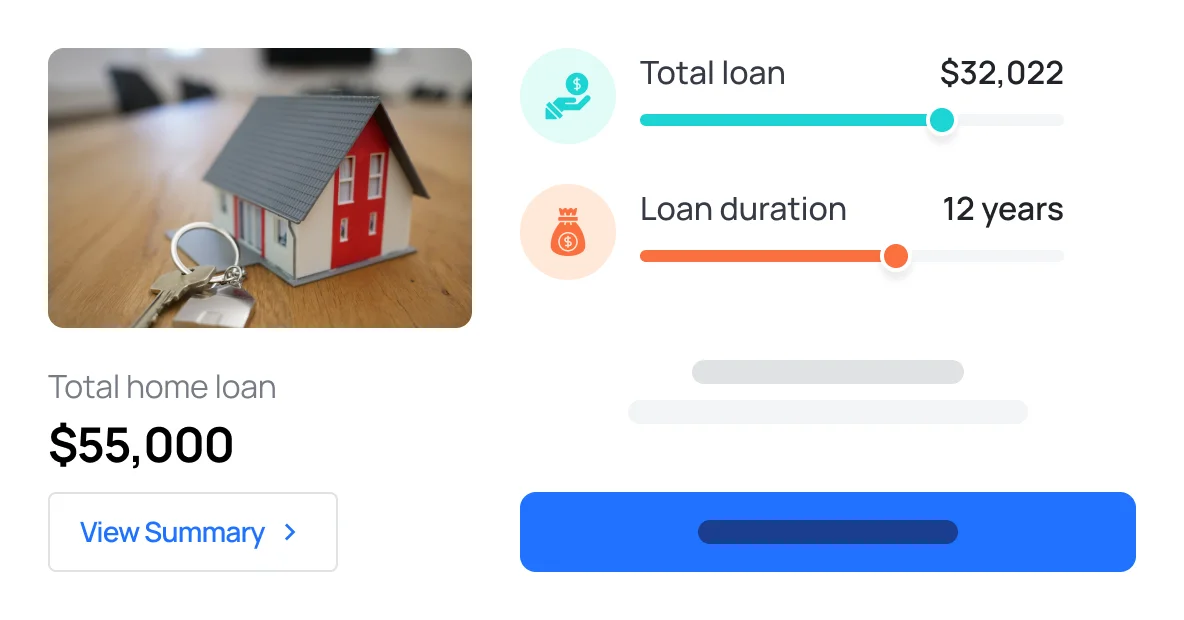

Take control of your financial future with our tailored loan solutions

We've valued thousands of properties. It's what we do.

Our mission is to provide comprehensive property valuations which empower you to make decisions with confidence. We strive to be the trusted partner for property owners, financial and real estate professionals, delivering exceptional service tailored to their unique needs.

Competitive Pricing

We believe that high-quality valuations should not come with an exorbitant price tag. Our commitment to competitive pricing ensures that our clients receive

exceptional value for their investment

Transparent and Ethical Practices

Integrity is at the core of our values. Our commitment to

transparent and ethical valuation practices has earned us the trust and respect of our clients

Compliance and Regulation

Our valuers are well-versed in local laws andregulations, ensuring our valuations adhere to the highest standards of compliance and

accuracy

Broad Network across South Africa

Our vast network of accredited valuers extends across the nation. This extensive reach enables us to offer localized insights and reliable valuations in different regions, making us a preferred choice for clients seeking national coverage.

Customized Valuation Solutions

We understand that each client’s requirements are

distinct.

That’s why we offer personalized and flexible valuation solutions tailored to suit specific needs.

Unparalleled Customer Service

Our client-centric approach means exceptional customer

service. We value open communication and responsive support throughout the valuation

process.

Sally Tailor

Martin Jones

Thanks to PageBolt, I was able to get the loan I needed and get back on my feet.

David Fowler

I was pleasantly surprised to receive a response so quickly, and the terms of the loan were very reasonable.

FAQS

All you need to know

Commercial | Industrial | Residential

- Insurance Valuations – Sectional Title and Freehold

- Divorce

- Deceased Estates

- Municipal Objections

- Representation in Valuation Court

- Appeal Board for Municipal Objections

- Sales and Purchases

- Second Opinions

- Rental Determination

- Financial Services

Before disposing of the property, it is crucial to determine its fair market value. Property valuation involves assessing various factors, including the property’s location, size, condition, recent comparable sales, and the overall real estate market trends.

This valuation helps in setting an appropriate selling price and understanding the potential return on investment.

Yes we specialize in it. Asset disposal of a property refers to the process of selling or getting rid of real estate assets that are no longer needed or desirable.

There are several reasons why property disposal may be necessary. For businesses, it could be due to relocation, downsizing, or changes in business

strategy.

In the case of individuals, property disposal may happen due to financial reasons, moving to a new location, or inheriting property they do not intend to keep.

Absolutely. You can rest assured that your valuations will be backed by highly-certified valuers, recognised by the official bodies in the country.

- We have practised valuations for 30 years.

- Certified with the South African Council for the Property Valuers Profession (SACPVP).

- Appointed by the Dept of Justice as a Sworn Appraiser to the High Court of South Africa.

- A member of of the South African Institute of Valuers (SAIV).

- Registered with Property Practitioners Regulatory Authority (PPRA).

Property valuers and estate agents serve different roles in the real estate industry, and both have their own unique contributions. Here are some reasons why property valuers are considered distinct from estate agents:

1. Objectivity and Independence:

Property valuers are independent professionals who provide unbiased opinions of value. Their primary focus is on determining the accurate market value of a property based on various factors and methodologies.

Estate agents typically work on behalf of property sellers or buyers, aiming to facilitate property transactions. While estate agents may provide estimated market values, their main objective is to negotiate and close deals, potentially introducing a subjective bias.

2. Expertise in Valuation:

Property valuers specialize in property valuation and possess specific knowledge and expertise in determining property values. They undergo formal education, training, and certification processes to develop their valuation skills.

Estate agents, while knowledgeable about the real estate market, primarily focus on marketing, sales, and property transactions rather than property valuation.

3. Legal Compliance:

Property valuers are often required to adhere to specific standards and regulations set by professional valuation bodies or government authorities. They must follow recognized methodologies and guidelines to ensure compliance with legal requirements.

Estate agents, although subject to regulations in many jurisdictions, primarily operate within the framework of property sales and marketing.

4. Comprehensive Valuation Reports:

Property valuers typically provide detailed valuation

reports that document their analysis, methodologies used, and supporting evidence. These reports are often used for legal purposes, financial decisions, or dispute resolutions.

Estate agents, while providing information on property values, may not provide the same level of comprehensive documentation as property valuers.

5. Specialised Focus:

Property valuers specialize in property valuation and devote their expertise to this specific area. They possess in-depth knowledge of valuation principles, methodologies, and market factors that influence property values.

Estate agents, on the other hand, have a broader focus that includes property marketing, sales negotiation, client representation, and customer service.

6. Different Client Needs:

Property owners or individuals seeking property valuations often have specific requirements, such as legal compliance, financial planning, tax assessments, or dispute resolution.

Property valuers are well-equipped to address these needs and provide the necessary expertise and documentation.

Estate agents primarily focus on marketing and facilitating property transactions, aiming to match buyers and sellers.

It’s important to note that while property valuers provide objective property valuations, estate agents play a crucial role in marketing, promoting, and facilitating property transactions. Both professionals can complement each other’s services, depending on the specific needs of property owners or buyers.

The short answer is an emphatic, No!

One of the main tools in the sales arsenal of an estate agent is producing market-related ‘property valuations’ for their clients. However, SAIV (the South African Institute of Valuers) has made strong objections to the PPRA with regard to this, stating that agents are neither qualified nor legally allowed to conduct valuations, and are putting the credibility of both industries at risk.

Unless you are a registered property valuer with SACPVP, you cannot undertake any property valuations nor offer property valuations as you would be in contravention of the Property Valuers Profession Act and the Property Practitioners Act”.

When conducting a valuation on a property, several factors should be considered to arrive at an accurate assessment of its market value. Here are some key factors that property valuers typically take into account:

1. Location: The location of a property is a critical factor in its valuation. Factors such as proximity to amenities (e.g., schools, shopping centres, transportation), desirability of the neighbourhood, accessibility, and the overall demand for properties in the area can significantly impact its value.

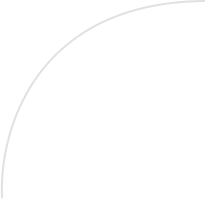

2. Size and Physical Characteristics: The size of the property, including the land and any structures on it, is an essential consideration. Valuers assess the square meterage, layout, number of rooms, bedrooms, bathrooms, and overall condition of the property. Features like architectural design, construction quality, and materials used may also influence the valuation.

3. Market Conditions: The current state of the real estate market, including supply and demand dynamics, prevailing interest rates, and economic factors, plays a crucial role in property valuation. Valuers analyse market trends, recent comparable sales, and the level of competition in the area to assess how these conditions impact the property’s value.

4. Comparable Sales: Comparative analysis involves assessing recent sales of similar properties in the same or similar locations. Valuers look for comparable properties that have similar attributes (e.g., size, condition, age, amenities) to establish a benchmark for the property’s value. This helps in determining a fair and realistic market value.

5. Property Age and Condition: The age and condition of the property affect its value. Newer properties or those in excellent condition may command higher values, while older properties or those in poor condition may have lower values. Valuers consider factors such as maintenance history, renovations, upgrades, and the overall state of repair to assess the impact on value.

6. Zoning and Land Use: The zoning regulations and permitted land use for the property can affect its value. Valuers consider factors such as zoning restrictions, development potential, and any legal limitations or obligations associated with the property.

7. Income Potential: In the case of investment properties, valuers may consider the income potential generated by the property, such as rental income or commercial lease rates. This may involve analyzing rental history, market rental rates, lease agreements, and projected income streams.

8. Environmental Factors: Environmental considerations, such as the presence of hazards, natural features (e.g., views, waterfront access), or environmental contamination, can influence property values. Valuers assess any potential risks or benefits associated with the property’s environmental factors.

9. Economic and Regulatory Factors: Economic factors, such as interest rates, inflation, and government policies related to the real estate market, can impact property values. Valuers take these factors into account to understand the broader economic context and its influence on property valuations.

10. Unique or Special Features: Properties with unique or special features, such as historical significance, architectural uniqueness, or rare amenities, may command higher values. Valuers consider these distinctive attributes and evaluate their impact on the property’s value.

It’s important to note that the specific factors considered in a property valuation may vary depending on the purpose of the valuation, local market practices, and any specific requirements or guidelines set by regulatory bodies or professional valuation organizations.